Context:

Regulatory reporting in financial services is shifting from static, manual processes to dynamic, AI-driven and cloud-native ecosystems. With increasingly complex regulatory demands and global compliance frameworks, financial institutions are seeking agile, scalable solutions.

This is a timely opportunity for AWS partners to offer powerful, outcome-focused services. This guide provides AWS-aligned strategies, tools, and actionable steps that consulting and technology partners can use to drive success in this space.

1. Understand the Growing Regulatory Pressure

Financial institutions face expanding regulatory expectations across jurisdictions. These include detailed disclosures, real-time data access, and evolving capital and risk standards. Traditional manual processes are no longer sustainable.

AWS Partner Opportunity: Offer diagnostic assessments and gap analyses using AI-powered analytics tools to help clients understand where they stand and how they can transition to cloud-based reporting systems.

2. Modernise the Regulatory Data Pipeline

Legacy infrastructure often fragments data collection, leading to inefficiencies and reporting errors. A robust data pipeline ensures consistency, scalability, and auditability.

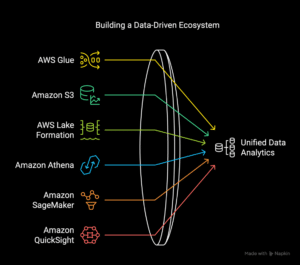

Implementable AWS Stack:

- AWS Glue for ETL and data preparation

- Amazon S3 as the central data lake

- AWS Lake Formation to manage data governance

- Amazon Athena for ad hoc queries

- Amazon SageMaker to build and train ML models for anomaly detection or data validation

- Amazon QuickSight for visualization and regulatory dashboards

Use Case Example:

A financial firm wants to validate regulatory capital calculations and compare them across different jurisdictions. AWS partners can architect a solution using Amazon S3 to store financial data, AWS Glue to prepare and clean it, SageMaker to train ML models for fuzzy matching of counterparty records, and Athena for real-time auditability. QuickSight can then be used by compliance teams to visualize gaps or misalignments. Integrating AWS CloudTrail ensures all access and changes are logged for full transparency. This architecture empowers financial teams with automated controls, audit readiness, and reduced compliance overhead.

3. Enable Non-Coders with AI-Driven, Low-Code Environments

Regulatory teams are often compliance experts, not code. Yet, enabling them to work within data pipelines is key to agility.

AWS Partner Solution:

- Deploy tools like Amazon SageMaker Canvas to allow non-technical users to build and visualize ML models.

- Offer onboarding services that blend regulatory process knowledge with low-code AWS environments.

4. Productize Repeatable Use Cases

Several regulatory needs—like Basel III, CRR II, and liquidity coverage—share data models and workflows across institutions.

What AWS Partners Can Do:

- Develop reusable modules or microservices (e.g., in AWS Lambda) for capital computation checks, stress testing frameworks, or risk aggregation.

- Package these as solution accelerators that reduce implementation time and boost recurring revenues.

5. Embed AI for Quality Assurance and Auditability

AI allows organisations to analyse 100% of reported data, not just samples. This builds trust with regulators and reduces reputational risk.

Action Items:

- Build statistical validation and anomaly detection using Amazon SageMaker.

- Integrate Amazon Comprehend for policy document comparison across languages and jurisdictions.

- Utilise Amazon Textract to extract structured data from regulatory filings.

6. Support Continuous Compliance

Point-in-time fixes are no longer enough. Institutions need continuous compliance monitoring and the ability to adapt to evolving requirements.

AWS-Based Framework:

- Use AWS CodePipeline to automate version control and updates of compliance logic.

- Implement CloudWatch and AWS Config to monitor system behavior and flag deviations.

- Build dashboards in QuickSight to continuously visualize compliance metrics.

7. Focus on People and Capability Building

Technology implementation must go hand-in-hand with user enablement. Cross-functional collaboration is essential for successful transformation.

AWS Partner Role:

- Lead cloud literacy programs tailored to compliance and finance teams.

- Help build internal communities of practice around AI and cloud for regulatory work.

- Co-develop proof-of-concept models with in-house teams to build lasting ownership.

In Summary:

AWS partners have an unprecedented opportunity to become strategic enablers of regulatory transformation in financial services. Partners can offer scalable, modular, and impactful services by aligning AI, automation, and secure cloud-native solutions with business goals. The future of compliance is dynamic, data-driven, and cloud-powered — this is your moment to lead.

Takeaway Actions for AWS Partners:

- Build reference architectures for regulatory analytics.

- Offer solution blueprints around common compliance scenarios.

- Monetise expertise through managed services and accelerators.

- Position your offering as essential to long-term compliance resilience.

By combining regulatory understanding with AWS technology, partners can deliver transformative value—today and into the future.

What are your thoughts as an AWS Partner?

What next?